Binary Options: a innovative way to invest

Binary Options are new financial instruments for trading price fluctuations in multiple global markets. Binary options can be traded on many underlying assets like forex currencies or stocks. Binary options are a simpler way to invest in the market as you are only betting on whether the price of underlying assets will go up or down during a certain time period.

OTC (over-the-counter) brokers offer these types of digital options. They match orders from different traders. You can invest as little as $1, or as much as $1,000. It all depends on where you trade Binary Options.

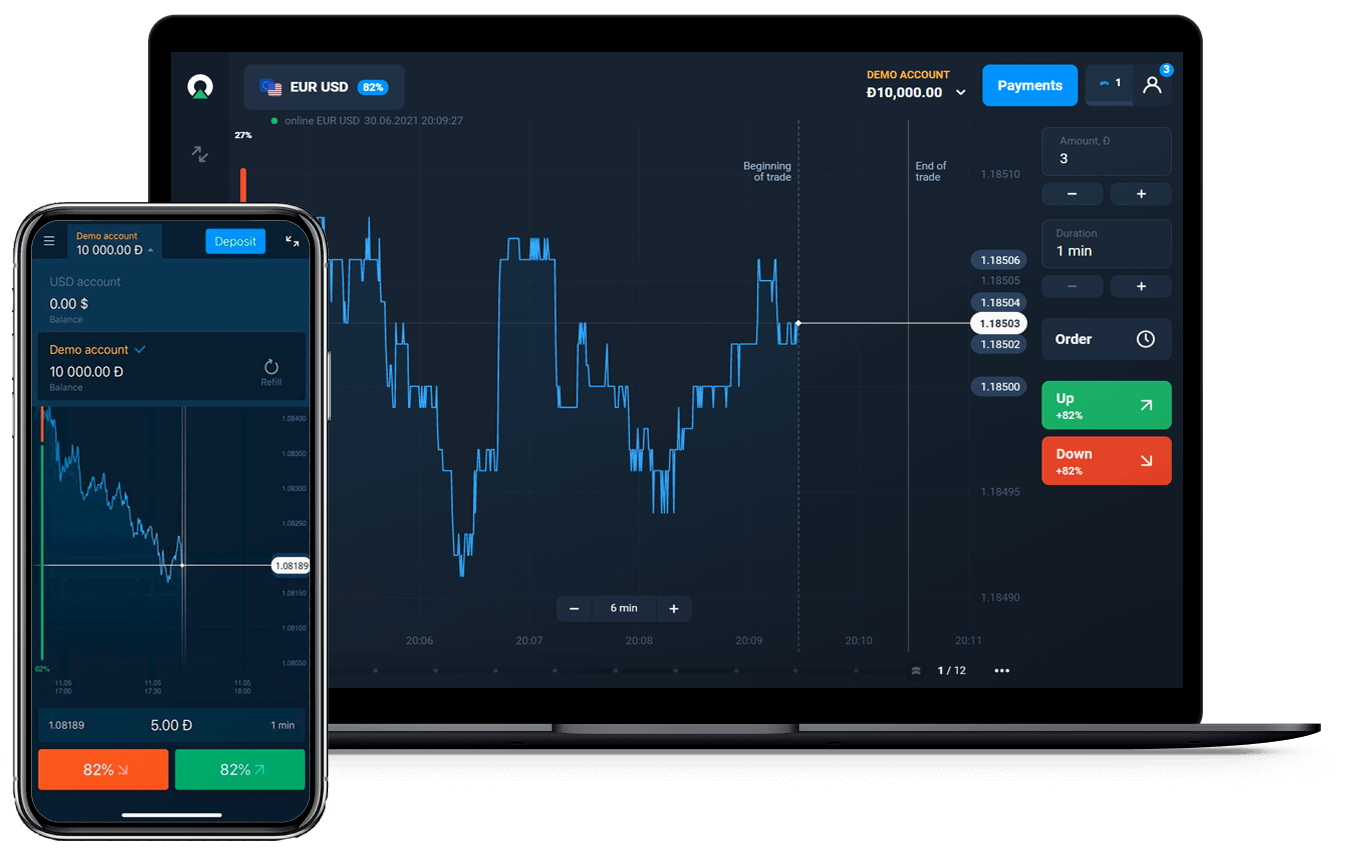

You can start binary trading even if you’re a novice. This means that you trade with virtual money and don’t risk any real cash.

Follow these steps to start binary trading:

- Select the asset that you wish to trade

- Forecast the future price movements (up and down)

- Select the expiration date of the option

- You can choose the amount of investment for the trade. It starts at $1

- Chose the strike price and start the trade.

- Wait until the expiration date is reached

- Depending on trade direction, the price must be either higher or lower than your strike price.

- Profit up to 100%, or you can lose your investment amount

For more information on binary options trading, you are free to see our complete guide which explains to you step by step how to trade binary options.

The Advantages of Binary Options

Trading Binary Options offer a great way to trade on the direction of an asset or commodity, whether it’s 60 seconds from now or 5 months from now. If you buy a Call Option and the price of the underlying asset is above the strike price at the expiration time, you will receive the full payout amount. If the trade expires and the price of the underlying asset is below the strike price, you will lose your investment. The same logic applies in the reverse situation. You can make money even when the price drops. If you buy a put option and the price drops, you get your investment back and also earn a fixed amount established at the time of buying the option. Binary options trading is very popular because it is very easy to understand, and generally offers higher returns compared to other financial derivatives.

Advantages:

- Your risks are limited

- Profitability can be high

- Trading for short-term and long term

- Simple to comprehend

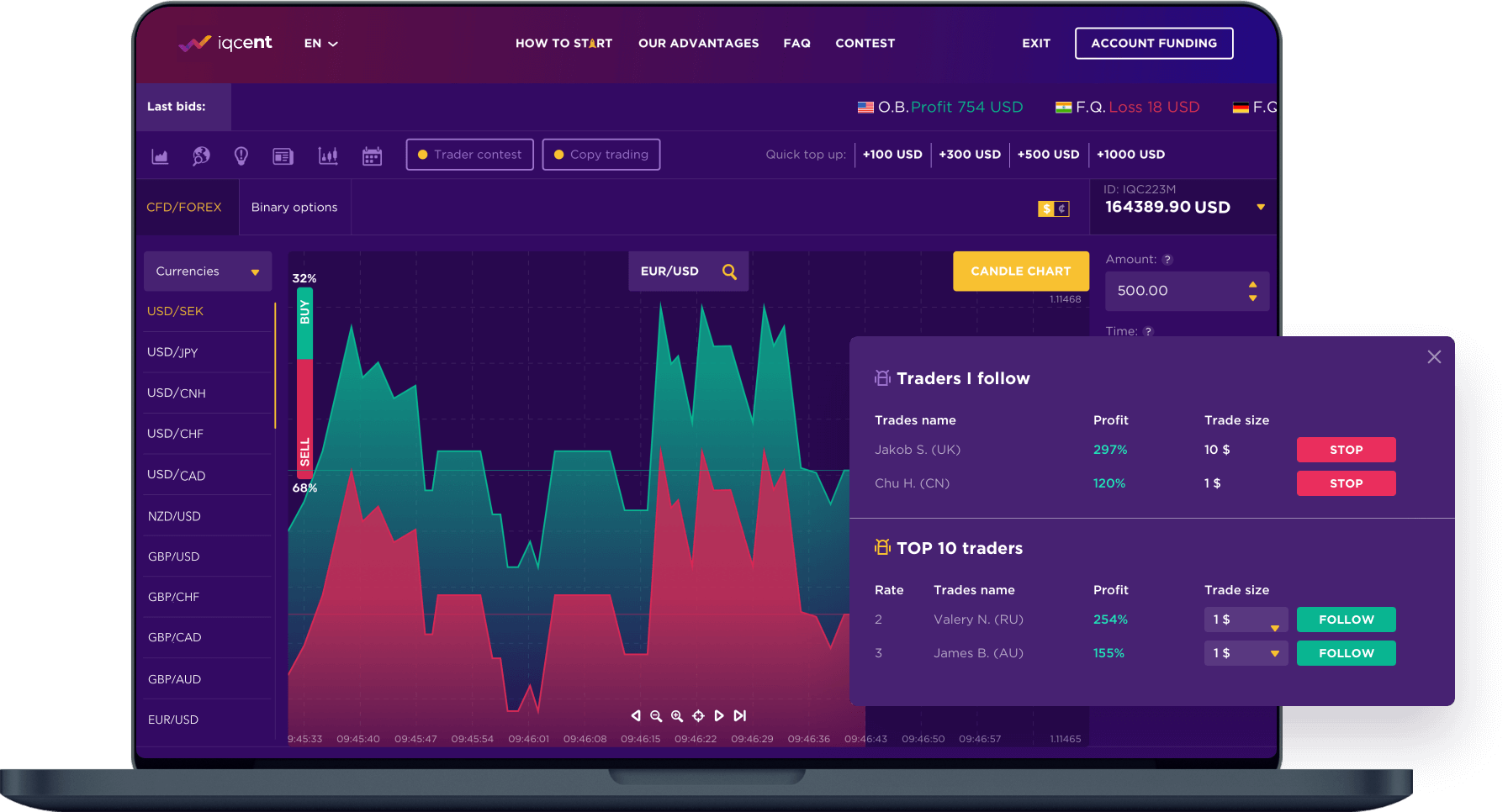

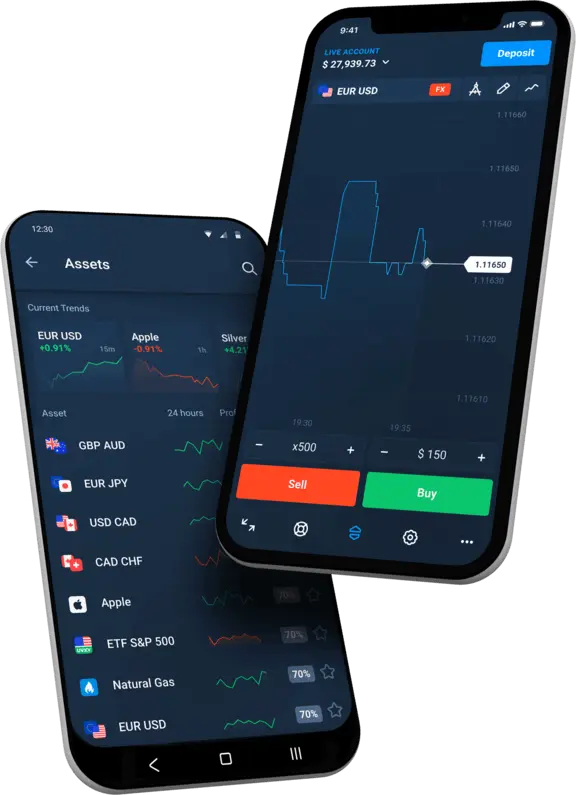

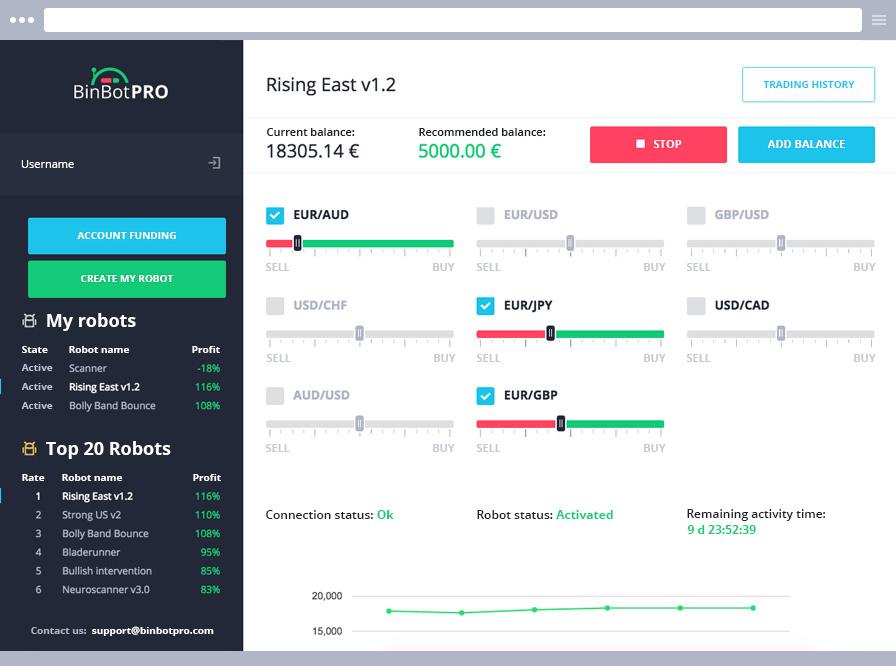

- Professional platforms available

- Can be used in a hedging strategy

- Useful in all financial markets

Disadvantages:

- It can be addictive

- There are many bad brokerage companies.

- It is not available in all countries

FAQ About binary option Trading

Are binary options legal?

Many traders wonder if Binary Options is legal. This is a crucial question when it comes to regulated, and secure online trading. There were many scammers working in Binary Options. These issues were highlighted by regulators who began to regulate the financial product more.

Binary Options can be traded in 99 percent of all countries. Retail investors may be subject to some exceptions.

Binary options is legal to trade.

Retail traders and investors can trade this financial derivative. Binary Options can be traded by professional traders too. Trades can be initiated by signing up with the right broker. Some Binary Options brokers may not be regulated. Some unregulated brokers are serious and honest, but many of these companies are not. If you are able to trade in these brokers, you need to be cautious. But in most cases, It is usually legal to open a binary options trading account.

Is Binary Options Banned in Europe?

Only professional traders are allowed to trade Binary Options in Europe. Regulated Brokers in Europe cannot accept retail traders for Binary Options trading. Professional traders will require more than EUR500,000 and high volumes of trading or financial education. You can trade Binary Options in Europe if you have a least 2 of these points. You can also trade with an offshore broker but is unregulated, it will be much harder to get your money back if it’s a scam.

Binary options are legal in the USA

Binary Options are an official financial product of the United States of America. Binary Options can be traded by American citizens, but only if it is done with a regulated and licensed broker in the USA such as the CFTC.

Regulations of binary options

There are very few binary options brokers that are regulated today. Many of them are not regulated. Different regulations apply to different countries. Before signing up for any broker, make sure you check the regulations in your country. Our experience shows that most brokers will accept clients from 90 percent of countries. If the broker is based in your country, you can check the broker’s site. Many brokers block clients from trading Binary Options in countries they do not allow it.

More information about binary options: